Understanding whether an independent contractor should be added to your company's payroll is essential for compliance with South African tax and labour laws. This article will discuss the critical factors to consider when determining if an independent contractor should be included in your payroll system.

Distinguish between true independent contractors and deemed employees

The distinction between true independent contractors and those considered employees depends on whether the amounts paid to the contractor align with the definition of remuneration in the Fourth Schedule of the Income Tax Act. For a comprehensive explanation, please see SARS’s Interpretation Note on the subject.

Independent contractors included in payroll

An independent contractor should be added to your payroll if their income satisfies the remuneration definition, which will be the case if:

They mainly provide services at the client's premises; and

They are subject to control or supervision regarding the manner in which they perform their duties.

In these cases, the definitions of employee, employer, and remuneration must be met for an independent contractor to be considered an employee for PAYE purposes.

Note that independent contractors who are deemed employees for PAYE purposes may still be treated as true independent contractors under labour law.

Employers are typically required to withhold PAYE and contribute SDL for all employees earning remuneration. These independent contractors' income is subject to PAYE (and SDL, if applicable) but not UIF, and will be reported on their IRP5s under code 3616.

Independent contractors excluded from payroll

True independent contractors are those who invoice clients for services rendered or goods supplied without any clear employment relationship. Their income does not meet the remuneration definition. These contractors are not considered employees and are not subject to employees' tax or UIF. Consequently, they should not be added to the payroll system.

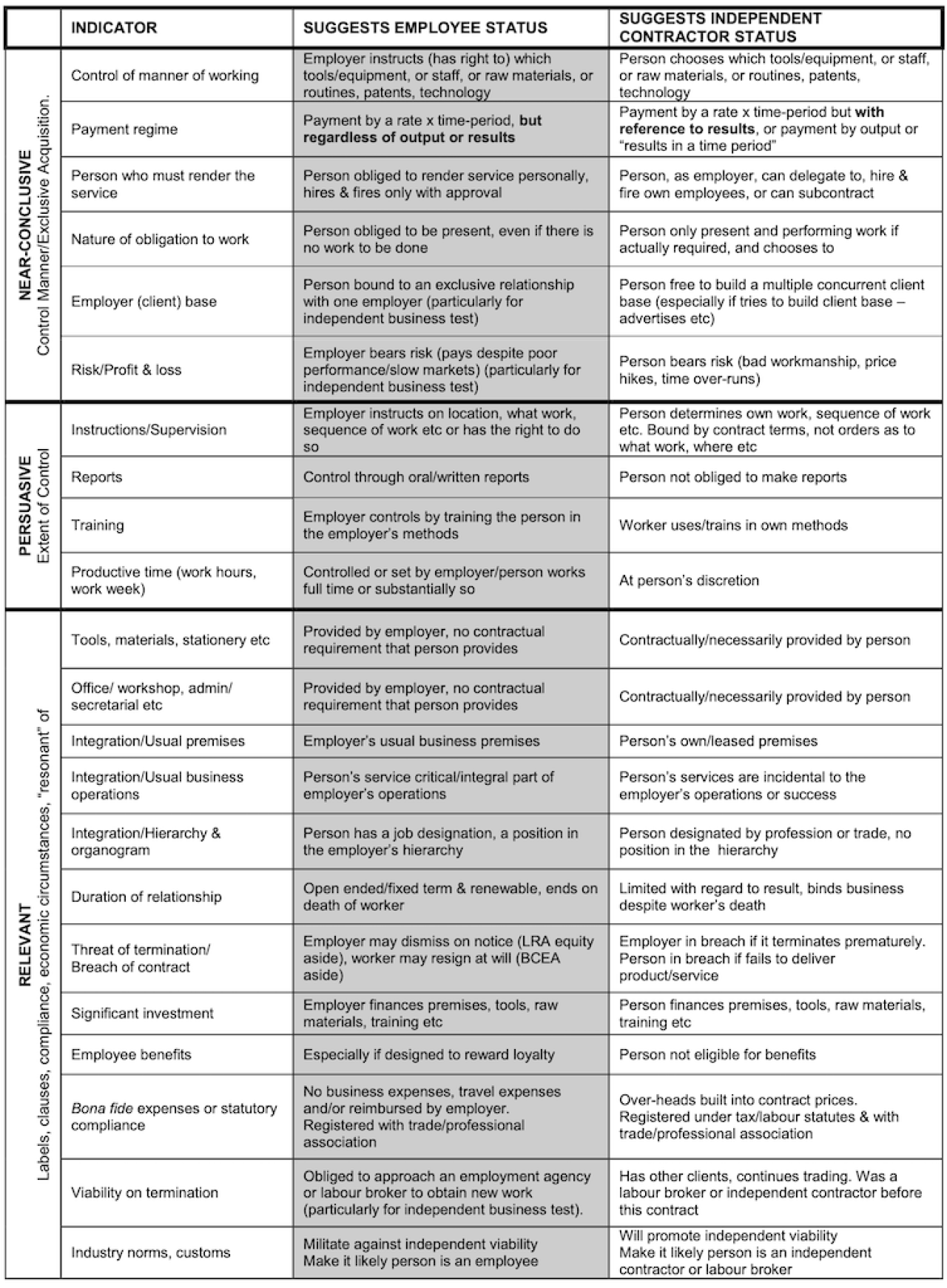

The common law dominant impression test

The below is an Annexure from SARS’s Interpretation Note and provides guidance on whether a worker is an independent contractor or an employee.

Implications for incorrectly not deducting tax

If the individual is not added to the payroll and SARS identifies this through reviewing expenses, the employer will be liable for the employee’s tax that should have been deducted, as well as penalties and interest.

Conclusion

Carefully assessing the nature of the working relationship with independent contractors is crucial to determine whether they should be included in your payroll. By understanding the distinction between true independent contractors and those deemed employees, you can ensure compliance with South African tax and labour laws.