This guide only explains how to get the S10(1)(o)(ii) tax exemption on SARS eFiling and does not deal with the technicalities of this exemption.

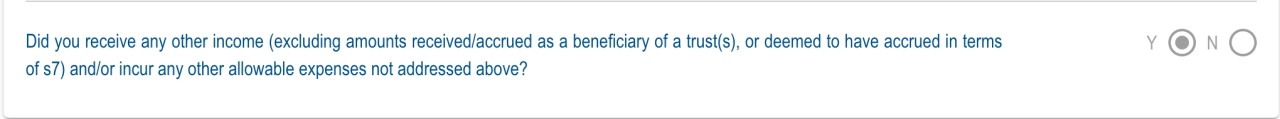

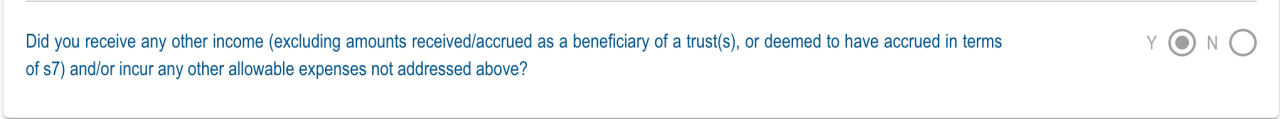

On your tax return, select "Y" to "Did you receive any other income (excluding amounts received/accrued as a beneficiary of a trust(s), or deemed to have accrued in terms of s7) and/or incur any other allowable expenses not addressed above?" listed under Standard Questions

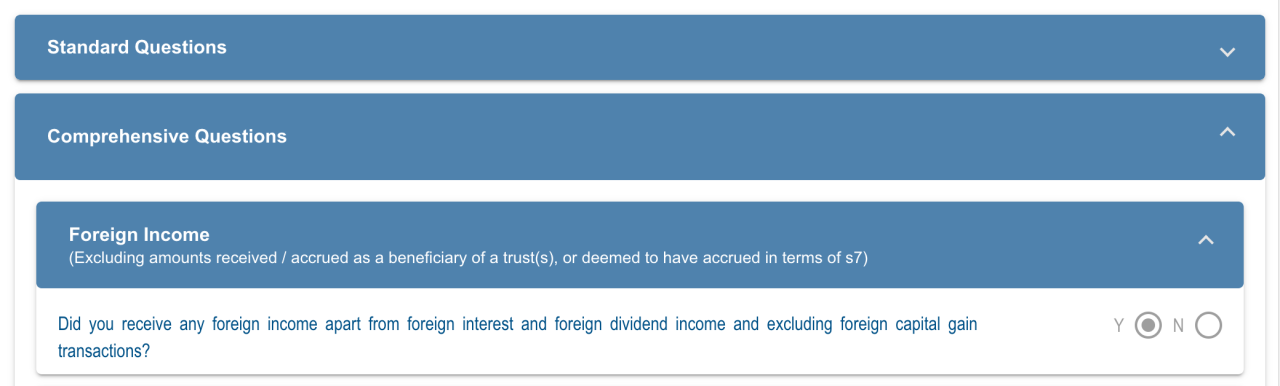

The above will result in the Comprehensive Questions being displayed in a new section under the Standard Questions.

Select "Y" to "Did you incur any expenditure that you wish to claim as a deduction that was not addressed by the previous questions?" listed under Comprehensive Questions

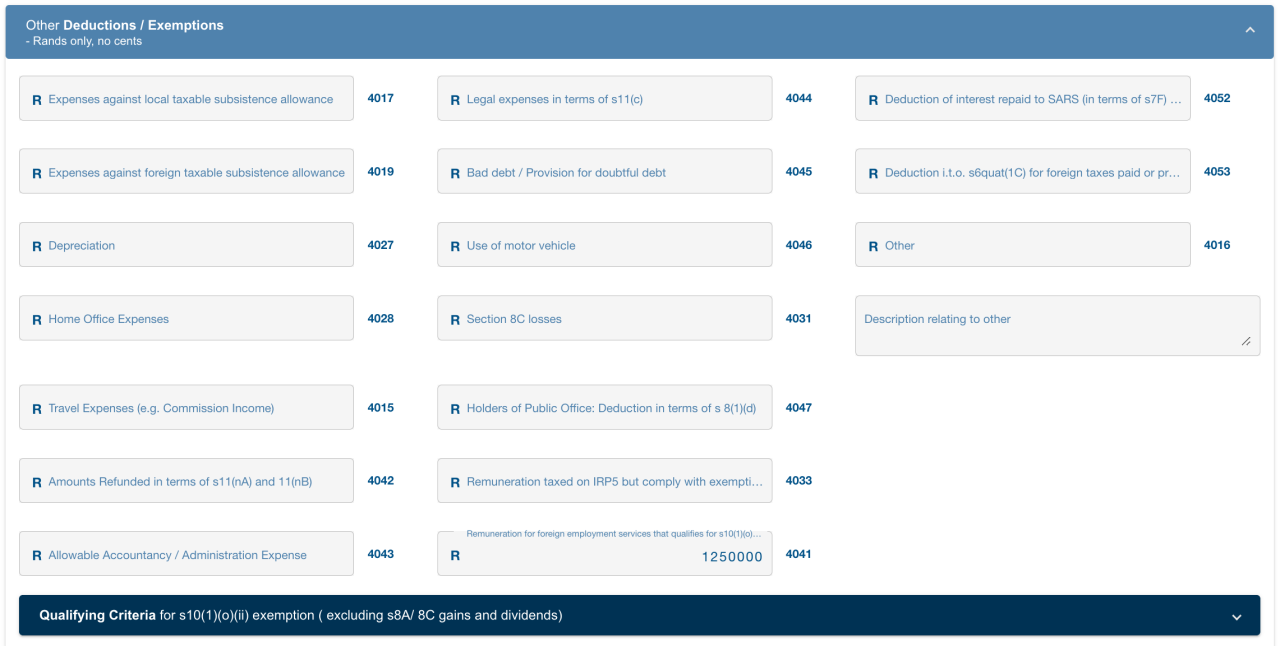

Navigate to "Other Deductions / Exemptions" and complete the relevant amount in 4041 for Remuneration for foreign employment services.

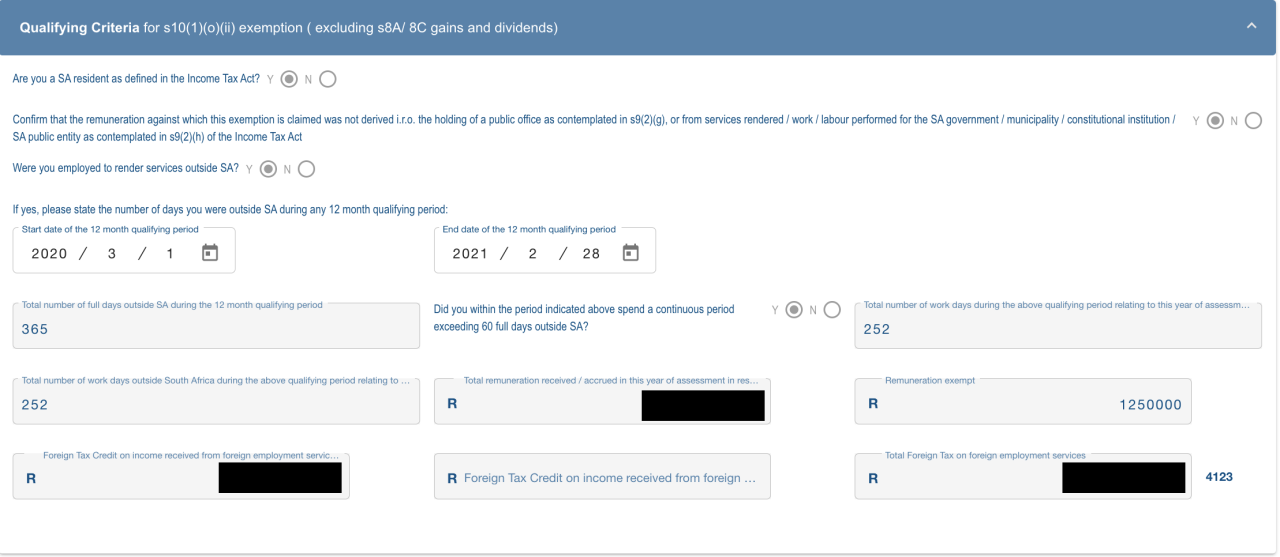

Once the amount has been completed navigate to "Qualifying Criteria for s10(1)(o)(ii) exemption ( excluding s8A/ 8C gains and dividends)" (see the bottom of the above image). Complete this section with your days, income and taxes.

You should now see your S10(1)(o)(ii) tax exemption on your tax calculation.

Need more information?

See our guide for Foreign Income Tax Exemption for South African Residents.